What You Need to Know (WYNTK) about Town of Saugerties and Ulster County (General) Taxes

Contact: Diane Friedmann, Tax Receiver

Address: 4 High Street, Saugerties, NY 12477

Phone: 845-246-2800 x339

Fax Number: 845-246-5942

Hours:

- Monday - Friday 8:00 a.m. to 4:00 p.m.

For information about your assessment, please visit the Assessor's office page.

For information about the STAR program, please visit this NY State STAR Program Landing Page or the STAR Forms page.

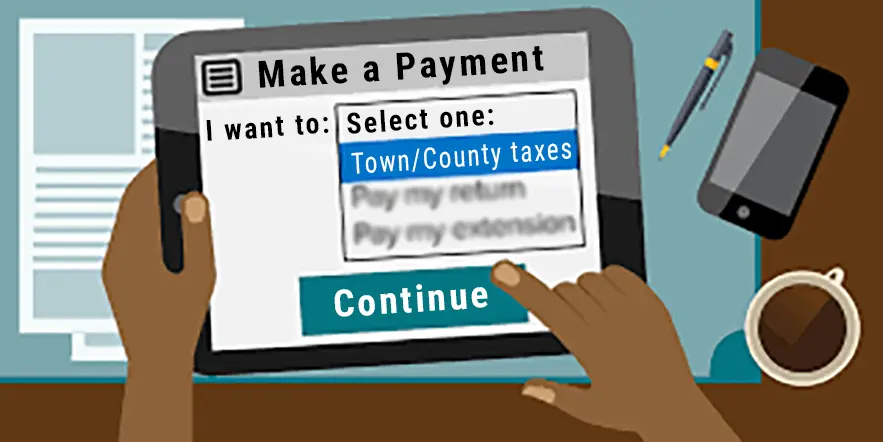

You can now pay your Saugerties taxes online if you wish.

Step one whenever you use online payments for Saugerties taxes, is to be certain you are using the right online tool for the right municipality (Town versus Village).

For information about any and all online payments that you can make for Town and Village utility and tax payments (as well as online school taxes), visit the page called "Saugerties Online Tax Payment - Be Sure You're Using the Right Tool".

Town of Saugerties Tax Collections and Payments

In the Town of Saugerties, the General Tax is a Town Tax and a County Tax. The Saugerties Tax Receiver is responsible for the billing and collection of current taxes for the Town of Saugerties and Ulster County. Tax bills are mailed during the first week of January. The tax bill covers the period of January 1st - December 31st of the same calendar year.

General (Town and County) taxes are due January 31st of each year penalty free. Full payments must be in the Tax Department on the last day of the month in January, or post-marked on that day at the Post Office. All mailed-in payments must have a valid U.S. Postmark on or before the due date. If a due date falls on a Saturday or Sunday, payments will be accepted on the following Monday.

Please pay careful attention to your tax bill. Due dates and penalties owed are time sensitive/dependent and sending the correct/exact amount will avoid multiple mailings and possible further penalties.

Payment Due Date Options - Single Payment - 1 Payment

- On or before the last day in January, no interest

- For payments made from 2/1 to 2/28, there is an additional 1% penalty payment due

- For payments made from 3/1 to 3/31, there is an additional 2% penalty payment due

- For payments made from 4/1 to 4/30, there is an additional 3% penalty payment due

- And for payments made from 5/1-5/31, there is an additional 4% penalty payment due. At this point, there is also a tax reminder notice fee of $2.00.

All checks are to be made payable to "Receiver of Taxes" for the EXACT AMOUNT that appears on the bill, plus interest or penalty, if applicable. All payments should be mailed or brought to the following address:

Receiver of Taxes

Town of Saugerties

4 High Street

Saugerties, NY 12477

Payment Due Date Options - Installment Payments - 2 Payments

- 1st payment on or before January 31st, no interest

- 2nd payment accepted February 1st – June 1st + 1% per month

- After June 1st, call Ulster County Department of Finance at 845-340-3431 for the correct payment information. All payments must be made (postmarked) to Ulster County Department of Finance. If there are any questions regarding your delinquent taxes or general tax, please again contact the Ulster County Department of Finance at 845-340-3431.

Receipts will be mailed to the Homeowner for mailed-in payments. Walk-in payment receipts will be issued at the time of payment to the person delivering payment.

If uncertain as to prior taxes, please call Ulster County Department of Finance at 845-340-3431.

You may be eligible for an exemption(s). March 1 is the deadline to apply for all exemptions for the following years’ taxes. For information, please call the Town of Saugerties Assessor Office at 845-246-2800 x335.

Third Party Notification: If you are either 65 years of age or older or disabled and you own and occupy a residence, you may designate a consenting adult third party to receive duplicate copies of your tax bills and notices of unpaid taxes until further notice. Applications may be obtained in the Receiver of Taxes office in our 4 High Street building, or by U.S. mail (address above).

Questions about Water/Sewer: If you have non-payment questions about water or sewer (e.g. suspected water leak due to high water bill), please contact Michele at the Glasco Water Plant, at 845-246-8671.

Additional links:

-

Village of Saugerties Tax Information (Paula Kerbert, Treasurer)

It's 2025! A new tax year has begun!

--> SAUGERTIES TOWN AND ULSTER COUNTY TAX PAYMENT PERIOD HAS BEGUN. <--

Payments can be made without penalty until Tuesday, January 31st.

To get to the online payment page, click here or on the image immediately below.

___________________________________________________________________________________