The final deadline for paying Town/County 2025 tax payments is Monday, June 2nd.

If you have not paid your taxes by the no-penalty (Friday, January 31st) date, you will incur a penalty, as per the following list:

- For payments made from 2/1 to 2/28, there is an additional 1% penalty payment due

- For payments made from 3/1 to 3/31, there is an additional 2% penalty payment due

- For payments made from 4/1 to 4/30, there is an additional 3% penalty payment due

- And for payments made from 5/1-5/31, there is an additional 4% penalty payment due

The last date for online payments is Monday, June 2nd, 2025.

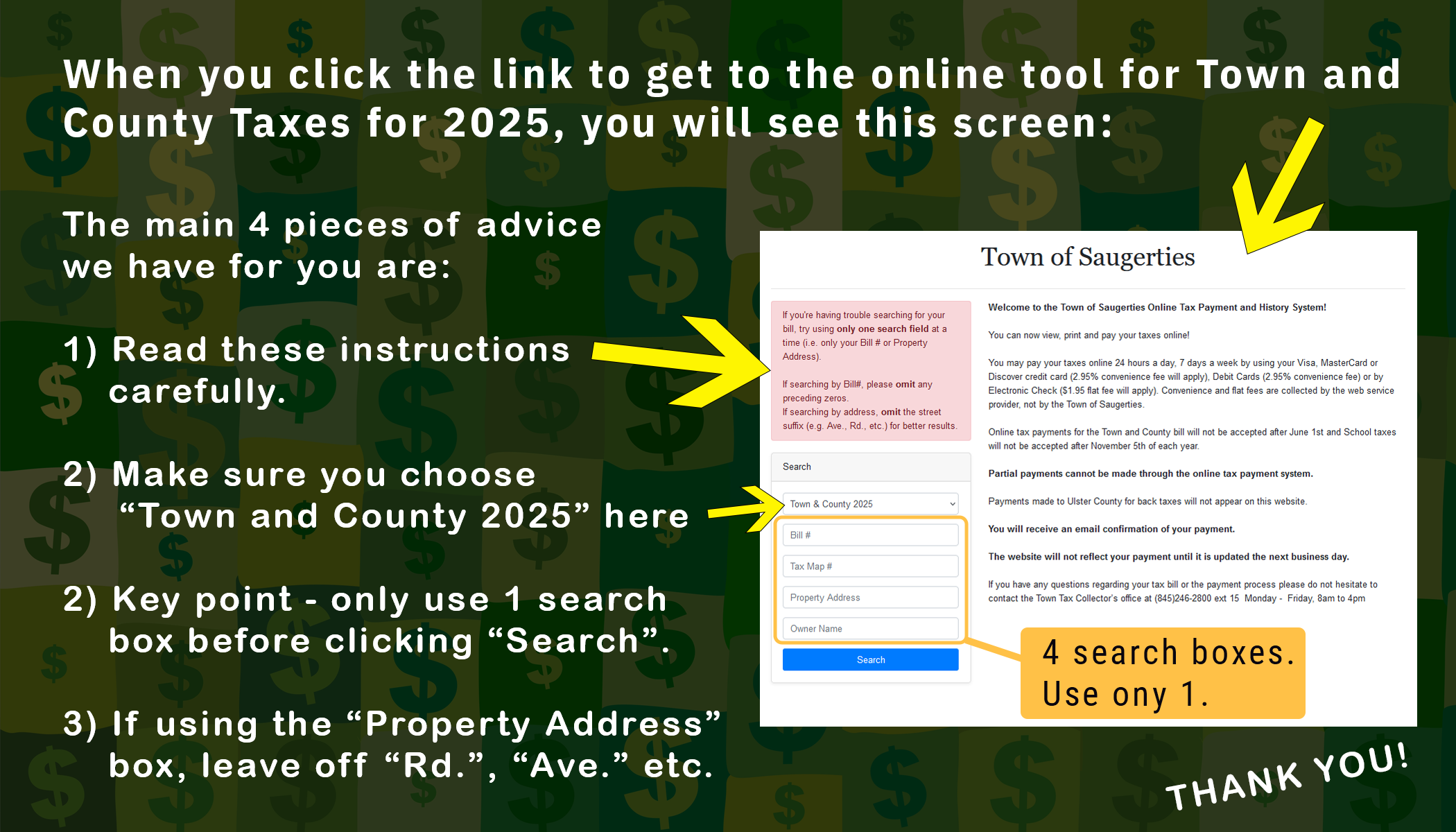

When you click the above link, the online Town/County tax payment page will open in its own browser tab. So if you need to tab back to these instructions, you should be able to do that.